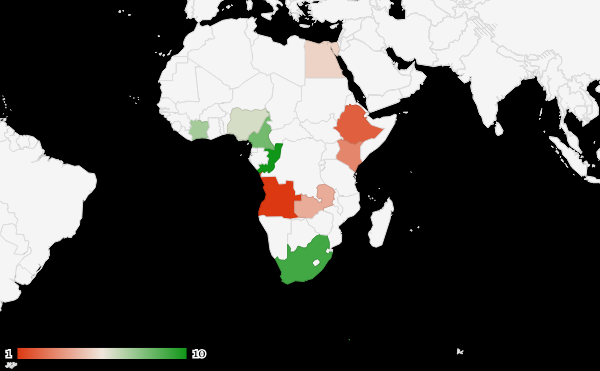

Angola, Ethiopia and Kenya are among the most indebted countries to China, with much of the loans going to Chinese-funded projects across the continent. China is also one of the biggest bilateral lenders in Africa and the Caribbean. The Chinese-funded Belt and Road Initiative project has had a productive outcome in terms of expanding the partner- country road network since its inception in 2013.

However, the Chinese loans have drawn intense criticism from the Western world, as many leaders from the global north have termed it a ploy to overwhelm African countries with unbearable debts. Currently, Angola is the biggest beneficiary of Chinese loans since the end of the decade-long civil war in 2000, when the country was seeking financial support to rebuild the country.

In Angola, Chinese companies have contributed much in various critical sectors, including water, energy, and green transformation. The Chinese state-owned corporation, PowerChina, built the Soyo-Kapary Power Transmission and Transformation Project, which is one of the biggest ever done in the country and the entire continent.

PowerChina has so far completed projects worth $10 billion since its entry into the Angolan territory two decades ago. Even as the country is raked into extensive loans owed to China, Luanda believes that the Chinese-funded projects will expand the needed developmental projects, primarily done by the Belt and Road Initiative, ChinaPower, and other state-owned corporations, and create employment opportunities as seen in the past.

In May 2024, the Chinese-contracted Gada Special Economic Zone was launched in the Ethiopian Oromia region, one of the country’s most populous regions, aimed at creating more employment opportunities for the youth. Amid the concerns over Ethiopia’s sustainability loans to China, which are the biggest after Angola, Addis Ababa has experienced expansive development and a deepened relationship with Beijing since Prime Minister Abiy Ahmed took over in 2028.

In 2003, Ethiopia became the first African country to host a Forum on China-Africa Cooperation (FOCAC) summit, which emphasizes economic and political cooperation between African countries and China. FOCAC was primarily created to counter other Asian and European organizations, especially the European Union’s influence on the continent. In 2012, China funded and constructed the African Union headquarters in Addis Ababa at a cost of $200 million.

China has also increased its influence in the East African subcontinent, with Kenya bolstering its relationship with Beijing to expedite the development of some critical infrastructure, such as roads, railways, and dams, among others.

In 2014, the Chinese state-owned construction company, China Road and Bridge Corporation (CRBC), secured a collateralized project deal funded by the Exim Bank through a partnership between the Kenyan and Chinese governments to construct the 472 km (293 miles) long Standard Gauge Railway (SGR) from Mombasa to Nairobi.

Kenya first secured from China $3.2 billion to construct the completed Standard Gauge Railway and later extended it to Naivasha dry port, 75 miles away from the capital, in 2015 for another $1.5 billion loan. The SGR loans had a hot potato as the project recorded huge losses at the early stages of its operationalization.

The Chinese Exim Bank is also set to foot the remaining passenger and cargo freight from Phases B and C of the Standard Gauge Railway connecting Kenya and Uganda from Naivasha, Kisumu, and Malaba at an estimated cost of $5.3 billion through a government-to-government agreement.

From Uganda. the railway line is also set to connect the rest of the Great Lakes region to the DRC, South Sudan, Rwanda, Tanzania, and Burundi, which is expected to start in September 2024. The 27.1-kilometer-long toll Nairobi Expressway was also built by the China Road and Bridge Corporation through a public-private partnership (PPC) contract with the Chinese government at a cost of US$560 million.