The first time Kenya’s economy tanked low was in 2008. This is the moment when the global economy was on the verge of total collapse, just in decades of strenuous work to stabilize the economy bruised in the tandem of global tensions.

In May 2008, Kenya’s inflation rate reached an all-time high of 31.50%, the worst in four decades since the elevation to a self-ruled state.

Kenya was also reeling from the devastating aftermath of 2007-2008 post-election violence, which dealt a moral blow to the international community following their deafening silence on archaic crimes against the innocent in Kenya.

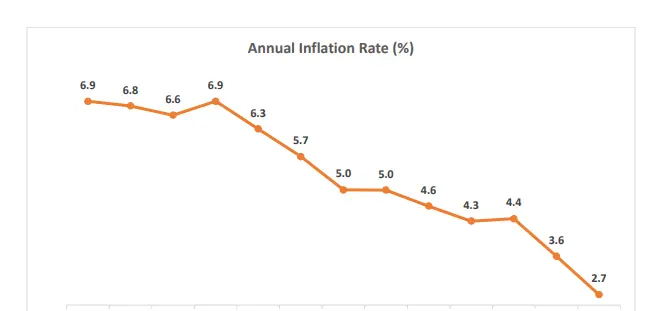

Now Kenya has recorded another all-time low annual inflation rate, breaching the mark of 3% to a new low level of 2.7% in October’s year-on-year inflation rate review. This comes in two weeks, following President Ruto’s public statement regarding his ambition to reduce the inflation rate to below the 3% band.

The drop in the inflation rate points to the general public’s focus on the basics, like food, staging a pause on secondary products. Despite the series of drops in the inflation rate, businesses still continue to experience the faultline agility, beyond the slackness performance in the COVID-19 era.

Since 2023, a good number of businesses have closed down, triggered by the enactment of the most controversial Finance Bill 2023, which became the melting point—leading to the bombastic anti-Finance Bill 2024 protest in the country.

Inflation in Kenya decreased to 2.70% in October 2024 from 3.60% in September 2024. The average inflation in Kenya stands at 8.65% from 2005 until 2024. The recent drop remains the lowest, a record achievement by the workaholic government, a brand Ruto’s administration has earned from the majority government apologists.

Kenya’s inflation rate dropped to 2.70% in October 2024, primarily due to several factors, including softer price increases, declines in transportation costs, and stable consumer prices.

There was a slowdown in the price increases in the basics, such as food and non-alcoholic beverages, which rose by 4.3% from 5.1% in the previous month. Similarly, housing and utilities saw a decrease in inflation rate from 2.6% to 0.4%.

The transportation sector experienced a significant price drop of 1.3%, compared to a slight increase of 0.5% in September 2024. The drop contributed to the overall decrease in inflation rate, which is also attributed to the gradual drop in prices on petroleum products.

The consumer prices remained steadily unchanged from the previous month at an increase of 0.25, indicating low pressures on prices during the period.